Mortgage Technology Budget is Stuck in Neutral

12/5/2023

During my high school years, I had the privilege of learning proper weight training techniques from my gym coach. He emphasized the importance of maintaining correct form and engaging multiple muscles in each movement. Our workouts pushed us to lift until failure, with poor form indicating that we were nearing our limits. This pursuit of strength was intense and painful, but it was our singular focus.

One of our ultimate goals was to join the esteemed “board” – a group of the strongest individuals to have ever graced our high school. Achieving this honor felt like an eternity, as their names were immortalized on the board. And yes, I made it onto the board, although the weight I lifted to achieve that feat eludes my memory now.

As I entered my 40s, with family and professional responsibilities, I still maintained my commitment to fitness. However, I realized that my traditional approach to weight training was no longer yielding results. I craved a long and healthy life for myself and my four sons, and I questioned the practicality and benefits of heavy lifting for someone in my stage of life. With that in mind, I decided to make a change.

I canceled my traditional gym memberships and embraced a High-Intensity Interval Training (HIIT) program. This new approach was expensive, uncomfortable, and required me to set aside my ego and preconceived notions about weight training. But within just six weeks, I can already feel the transformative effects taking place.

While I can still lift heavier weights than most men, I now prioritize specific muscle groups and focus on the practicality and efficiency of my workouts. The HIIT program has rejuvenated my fitness journey and set me on a path towards sustainable progress.

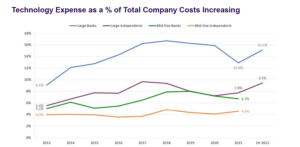

So, what’s my point? Just like my weightlifting journey, the mortgage technology sector needs to embrace change for progress. At Mortgage Advisor Tools, we’ve been analyzing a report by STRATMOR/MBA on mortgage tech budgets. The report suggests that, on average, mortgage lenders allocate 8.95% of their budget towards mortgage technology. While I’m uncertain about how this compares to other business sectors, it’s evident that the percentage is low. However, our Chief Marketing Officer, Blake Boyer, flagged another concerning trend. The technology budget assigned to mid-sized lenders has remained stagnant for over ten years. This observation highlights a lack of investment and innovation in the industry, especially when technology is playing an increasingly vital role in the mortgage lending process.

Source: PGR: MBA and STRATMOR Peer Group Roundtables www.mba.org/pgr

I have been on a soapbox for the last couple of years about the industry’s largest group of lenders being overlooked. It seems that everyone is overlooking them, from the media to conference planners and even mortgage technology lenders. The focus tends to gravitate towards where the money is, and understandably so. Large lenders have significant budgets and therefore capture our attention. However, what often goes unnoticed is that mid-size lenders account for nearly 60% of mortgage originations in the U.S. In some years, this amounts to a staggering $1 trillion.

Currently, lenders across the country are in the midst of budgeting for 2024. They sit in rooms armed with Excel spreadsheets, a Sharpie, and often half-formed opinions on which technologies and services to retain or eliminate from their operations. This process is simply part of the routine, a way to maintain the status quo. Just going through the motions, we will inevitably see this chart dip. It is what we are conditioned to do.

Maybe you’ve been placed on a list of one of the top lenders in the US. Perhaps one of the top lenders in your state or region. Top places to work. Whatever BOARD of achievement that brought prominence to an organization yesterday may need to be reconsidered. Everything we know and have worked towards has gotten us right where we are. Often this means wealth, growth, achievement, accolades, success, and recognition. However, our age is showing. Gen Z is wondering how we can help them achieve what they have been told is the American Dream.

Investing in technology is challenging. The space is noisy. We estimate that over 8,000 different technology solutions serve our multi-faceted industry. Doing the same workouts and going through the same exercises will likely not get us what we want. It may even cut our lives short. Change can feel expensive and uncomfortable, forcing us to leave our ego and “knowledge” at the door. It is time for the mortgage industry to quit checking the boxes and reflecting on yesterday’s achievements. The next generation needs us. It won’t be easy to innovate, automate, and enhance our technology stack. Burpees suck, but we could all be well served by a couple of jumping jacks. Whatever it is, a new regimen is overdue, and the time to start is now.